Professor John Robertson OBA

With only a 1969 SCE Higher in Economics, bare C pass, I’m deferring entirely to Grok AI on this one. If you’re capable, please enlighten me on any problems with his (Grok) analysis.

Grok – Was Brexit even more damaging for Scotland with its trade surplus than rest of UK?

Conclusion

Yes, Brexit was more damaging to Scotland’s trade surplus than to the rest of the UK’s deficit. The UK’s import-heavy profile turned barriers into a partial “benefit” (narrower deficit), while Scotland’s export reliance amplified losses—eroding potential surplus growth by £3-4bn annually and hitting GDP harder relatively. Non-EU trade (e.g., oil/services) masked some effects, but EU frictions remain a drag, with businesses reporting “significant challenges” in 2024-2025

parliament.scot. Long-term modeling (e.g., OBR, ECB) confirms Scotland’s higher vulnerability despite lower direct EU exposure (~18% of exports vs. UK’s 40%) sciencedirect.com +1

Evidence:

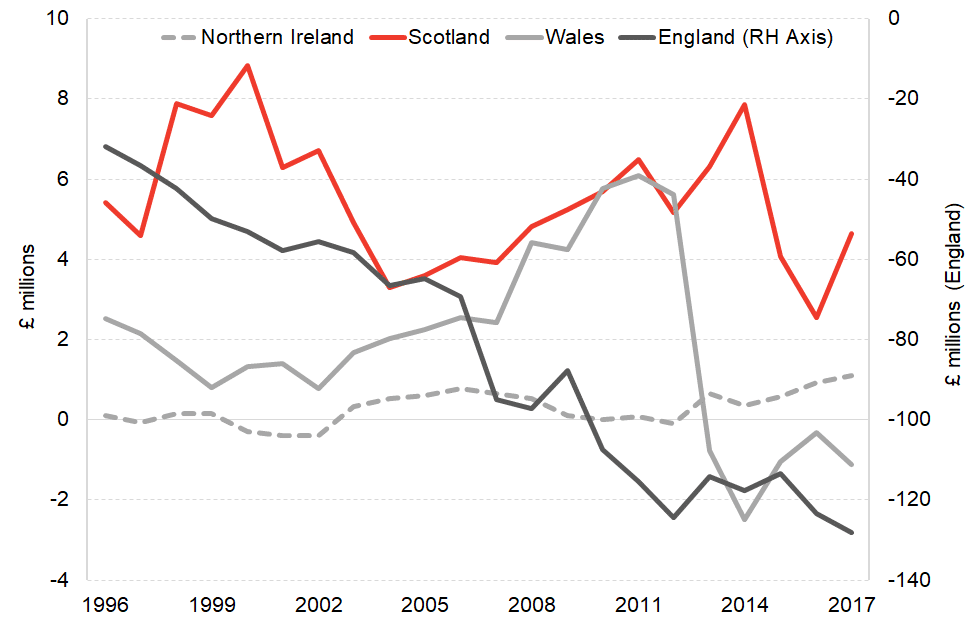

Overview of Brexit’s Impact on Trade Surpluses/BalancesBrexit, which fully took effect on January 1, 2021, introduced new trade barriers (e.g., non-tariff frictions like customs checks and regulatory divergence) between the UK and the EU. This disproportionately affected regions with strong export reliance on the EU. Scotland, unlike the rest of the UK, historically maintained a goods trade surplus (both overall and with the EU), making it more vulnerable to export disruptions. While absolute trade balance figures show mixed outcomes due to confounding factors like COVID-19 and global supply chains, modeling and sector-specific analysis indicate Brexit eroded Scotland’s surplus more severely on a relative basis compared to the UK’s overall deficit.

Key context:

- Scotland’s profile: High export intensity (exports 25% of GDP pre-Brexit vs. UK’s ~20%). Goods surplus with EU (£6.3 billion in 2019) and overall goods surplus (£12 billion in 2019).

- Rest of UK’s profile: Chronic goods trade deficit (overall £175 billion in 2019; £99 billion with EU). England (driving 85% of UK trade) had a large deficit (£45-50 billion estimated in 2019, inferred from UK totals minus Scotland/Wales/NI surpluses).

Pre- and Post-Brexit Trade Balance ComparisonUsing Office for National Statistics (ONS) data for total goods + services trade (annual, £ billions). Note: 2020 data distorted by pandemic; focus on 2019 (pre-Brexit baseline) vs. 2023 (post-stabilization).

| Region/Nation | 2019 Balance | 2023 Balance | Change (£bn) | % Change | Notes |

|---|---|---|---|---|---|

| Scotland | +20.5 (surplus) | +23.1 (surplus) | +2.6 | +12.7% | Absolute surplus grew slightly, but modeling shows £3-4bn lost potential from export barriers (7.2% lower exports vs. EU membership counterfactual). Goods surplus with EU eroded due to export frictions. |

| England | -~48 (deficit, est.) | -27.9 (deficit) | +20.1 | -41.9% | Deficit narrowed (benefited from steeper EU import drop). Drove UK’s overall improvement. |

| Rest of UK (ex-Scotland) | -~49 (deficit, est.) | -24 (deficit, est.) | +25 | -51% | Similar to England; import reductions offset export losses. |

| UK Overall | -29.3 (deficit) | -32.1 (deficit)* | -2.8 | -9.6% | Slight worsening, but goods deficit with EU narrowed from £99bn (2019) to ~£80bn (2023) as imports fell 18-22% vs. exports’ 9%. Services surplus cushioned impact. |

*2023 UK deficit revised to -£29.1bn in some ONS updates; 2024 improved to -£25.5bn.

- Sources for figures: ONS International Trade in UK Nations (2019/2023 bulletins) ons.gov.uk +1; Scottish Government/ONS 2019 data facebook.com; UK totals from ONS Balance of Payments ons.gov.uk +1. England/rest-of-UK estimates derived from UK totals minus devolved nations’ reported surpluses.

Why Brexit Was More Damaging for Scotland’s Trade Surplus

- Export Dependency and Asymmetry:

- Scotland’s economy is more “open” and export-led (e.g., food/drink, chemicals, whisky—40% of exports to EU pre-Brexit). Brexit’s frictions hit these harder: EU goods exports down ~12% (2021-2023) vs. UK’s 9%, with £3bn annual loss vs. counterfactual gov.scot.

- Rest of UK (deficit-heavy) benefited from disproportionate import falls (22% vs. 9% exports to EU), shrinking its deficit obr.uk +1. Scotland’s surplus amplified export pain while import drops provided less offset.

- Relative vs. Absolute Impact:

- Absolute: Scotland’s surplus grew modestly (+13%), but this masks lost growth—exports stagnant since 2019 (real terms £11-12.5bn), vs. potential +7-10% under EU continuity bprcdn.parliament.scot +1. UK’s deficit stabilized/improved relatively.

- Relative: Scotland’s export-to-GDP ratio fell from 25% (2019) to ~19% (2023), vs. UK’s milder drop. EU-specific goods surplus shrank ~20-25% in potential terms believeinscotland.org.

- Sector and Evidence:

- Goods with EU: Scotland’s 2019 EU goods surplus (~£6.3bn: £16.5bn exports – £10.2bn imports) faced asymmetric hits—exports dipped temporarily (9-14% Q1 2021), imports fell persistently (22%) gov.scot. Net: Surplus preserved short-term but growth stunted (e.g., food exports -15-20%).

- Broader economy: £4bn GDP hit from barriers (2% long-term), vs. UK’s 1-1.5% gov.scot +1. SNP/Gov.scot analysis: Scotland “disproportionately badly hit” due to surplus structure thenational.scot +1.

Sources at: https://x.com/i/grok?conversation=1990748877675188364

So GROK can be used productively! Asking the right question is clearly necessary, and possibly having community notes back-up. I hope readers with experience of economics can confirm this very damning (of our precious union) information.

LikeLiked by 2 people

The majority want back in the EU. Labour is blocking it.

LikeLiked by 1 person