Support Talking-up Scotland's work to counter the lies and get you the facts, daily, at: https://www.crowdfunder.co.uk/checkout/help-talking-up-scotland-tell-truth-about-scotland/payment/nBQxjVzq/details

Professor John Robertson OBA

From Grok with the above question in the headline:

No, the Government Expenditure and Revenue Scotland (GERS) figures are not a measure of Scotland’s economy after 20 years of independence. GERS provides an annual snapshot of Scotland’s public finances under the current constitutional arrangement as part of the UK, estimating revenue raised and public spending allocated to Scotland. It reflects the existing fiscal framework, where Westminster controls significant portions of revenue (around 70%) and spending (around 40%), including items like defense and debt interest that an independent Scotland might not prioritize.

https://www.snp.org/gers-figures-explained/ https://en.wikipedia.org/wiki/Government_Expenditure_and_Revenue_Scotland https://www.thenational.scot/news/19130594.open-minds-6-truth-gers—scotlands-annual-economic-political-football/

GERS does not project or model the economic performance of an independent Scotland, as it is based on current UK policies, tax structures, and spending decisions. An independent Scotland could adopt different fiscal, monetary, and economic policies—such as tailored tax rates, migration policies, or investment priorities—that could significantly alter its economic trajectory over 20 years. For example, the Fraser of Allander Institute notes that GERS is a “backward-looking estimate” and does not account for structural changes or new macroeconomic risks and opportunities that independence might bring. https://www.thenational.scot/news/23724841.role-gers-figures-scottish-independence-debate/ https://fraserofallander.org/gers-guide/

Proponents of independence argue that Scotland’s natural resources and potential for policy flexibility could lead to stronger economic performance, citing comparator nations with higher GDP per capita. Conversely, critics highlight GERS’s notional deficit (e.g., £26.5 billion or 11.7% of GDP in 2024-25) as evidence of fiscal challenges, though this assumes unchanged UK-based spending and revenue patterns. Both sides agree GERS is a starting point for discussion, not a definitive predictor of an independent Scotland’s economy. https://www.thenational.scot/news/19130594.open-minds-6-truth-gers—scotlands-annual-economic-political-football/

https://www.bbc.co.uk/news/uk-scotland-45271076

To assess Scotland’s economy after 20 years of independence, one would need to model scenarios based on specific policy choices, economic growth rates, trade relationships, and global conditions, none of which GERS attempts to do. For broader economic measures, sources like Quarterly National Accounts Scotland (QNAS) or GDP figures would be more relevant. https://www.gov.scot/publications/government-expenditure-revenue-scotland-2022-23/

https://www.gov.scot/publications/government-expenditure-revenue-scotland-gers-2021-22/pages/1/

News from 2050 :

The Scottish Government was among the first countries to offer aid to the bankrupt English Parliament as it , once again , faced growing demands from its people to copy the Scottish model and have a fair tax regime .

Continuing water shortages , increasing blackouts due to energy shortfalls and the increasing costs of Private Healthcare in England have seen an expansion of charities along the Tweed border as more and more desperate families move north .

In an ironic reflection of his Stop the Boats election slogan from 2028 , ageing PM Nigel Farage ( or Dictator Supreme as he prefers to be known ), has ordered his border militia to ”Stop the Refugees” as he bids to prevent the increasing loss of people from the Great English Empire , as it was renamed after his election .

Speaking from his Monaco retreat , the Dictator Supreme reiterated that news stories depicting the Great English Empire as a ”Basket Case” were Fake News and that his introduction of Rationing and Martial Law were simply short term measures to offset the rising rate of inflation – which was also clarified as ”Fake News” by the Director General of the Farage Broadcasting Corporation ( renamed in honour of its most ubiquitous guest speaker ).

LikeLiked by 3 people

FAO, Prof John.

https://www.stuff.co.nz/politics/360792427/government-pays-almost-150-million-cancel-new-ferries-contract?fbclid=IwY2xjawMMMBJleHRuA2FlbQIxMQABHsQAVZCF1nzGgWsj7PafJ-M3WJERvCPsNREAHxg_XKP8nv8e5R6lMynV3Pde_aem_Pv5k4CxiUfOW1arvON4DVw

LikeLiked by 1 person

Thanks alex

On it

John

LikeLike

So Grok advises: ‘To assess Scotland’s economy after 20 years of independence, one would need to model scenarios based on specific policy choices, economic growth rates, trade relationships, and global conditions,’ Just like that?

My own question to Grok: ‘What forecasts are made and by whom of the UK’s economy in 20 years? How reliable, how accurate are such 20 year forecasts likely to be? Is there a distinction to be drawn here between extrapolation of current/recent trends and ‘forecasts’?”

Grok’s long response includes (with my emphasis): ‘Forecasting the UK economy 20 years into the future (to 2045) is a complex task, and few organizations provide detailed projections over such a long horizon due to the inherent uncertainties involved.

‘Office for Budget Responsibility (OBR) provides long-term fiscal and economic projections, often extending to 50 years, in its Fiscal Risks and Sustainability Report. In its 2024 report, the OBR projects that, without policy changes, public sector net debt could rise to over 270% of GDP by the mid-2070s, implying significant fiscal challenges by 2045. This is driven by an ageing population, climate change costs, and rising geopolitical tensions.

‘For 2045 …. it does not provide precise GDP growth figures for that year. Instead, it assumes average potential output growth of around 1.67% annually from 2025 to 2028, with labour supply growth slowing due to demographic shifts and productivity growth recovering to a long-term rate of about 1%.

PwC UK Economic Outlook (July 2024) emphasizes structural challenges to achieving high growth. … However, no specific GDP growth rate for 2045 is provided, though medium-term projections (to 2026) estimate growth at 1.7–2% annually.

Other Institutions (IMF, OECD, etc.): the International Monetary Fund (IMF) and Organisation for Economic Co-operation and Development (OECD) typically provide shorter-term forecasts (up to 5–7 years). … These organizations do not publish 20-year forecasts .

Private Sector and Academic projections: organizations like Goldman Sachs, KPMG, and the National Institute of Economic and Social Research (NIESR) provide shorter-term forecasts (up to 2026–2027), …. These institutions rarely extend projections to 2045.

‘Studies by the Resolution Foundation or Cambridge Econometrics, occasionally model long-term scenarios but focus on specific issues like productivity or regional disparities rather than comprehensive GDP forecasts.

Reliability and Accuracy of 20-Year Forecasts: Long-term economic forecasts (20 years or more) are inherently uncertain due to unpredictable factors such as technological breakthroughs, geopolitical events, policy changes, and global economic shifts.

Limited Reliability: the OBR’s Forecast Evaluation Report (July 2025) highlights that even five-year forecasts are prone to significant errors due to unexpected shocks like the COVID-19 pandemic, the Ukraine war, and energy crises. Over 20 years, uncertainties multiply, as factors like climate change, AI adoption, or demographic shifts can dramatically alter economic trajectories. For example, the OBR notes that its 2019–2023 forecasts for 2023–24 were off due to unforeseen events, with errors in fiscal forecasts reaching £92.3 billion due to policy changes alone.

Scenario-Based Approach: to address uncertainty, forecasters like the OBR use scenarios (e.g., tariff shocks, productivity variations) rather than single-point estimates. These scenarios provide a range of outcomes but still rely on assumptions that may not hold over 20 years.

Accuracy of forecasts: historical data shows that long-term forecasts are often inaccurate. For instance, pre-2008 forecasts failed to predict the global financial crisis, and pre-2020 forecasts missed the COVID-19 impact. The OBR’s evaluation shows that economic shocks and policy changes significantly skew even medium-term forecasts.

Key Variables: Accuracy depends on correctly predicting productivity, demographics, and global trade conditions. Productivity growth, a major driver of long-term GDP, is notoriously hard to forecast.‘

There are also Data Limitations and ‘over 20 years, such data issues compound uncertainty.’ And factors reducing accuracy include Geopolitical Risks, Technological Change, Demographics: an ageing population – with migration patterns and health improvements capable of altering labour supply in unforeseen ways.

Extrapolation vs. Forecasts: there is a clear distinction between extrapolation of current/recent trends and economic forecasts.

Also, ‘Many forecasts come from established institutions (OBR, IMF, etc.), which may embed biases toward conventional economic assumptions or government-aligned views. For example, the OBR’s projections assume no major policy reversals, which may underestimate political or social shifts.

Conclusion: few organizations provide explicit 20-year forecasts for the UK economy due to the high uncertainty involved.

‘These forecasts are only moderately reliable and likely to be inaccurate due to unpredictable factors like technological change, geopolitical shocks, and policy shifts. Extrapolation of current trends (e.g., 1–2% growth, rising debt) is simpler but less robust, as it ignores dynamic changes that forecasts attempt to model.’

So when Grok stated that ‘To assess Scotland’s economy after 20 years of independence, one would need to model scenarios based on specific policy choices, economic growth rates, trade relationships, and global conditions‘ this is something that it doubts can even be done satisfactorily for the existing UK!

LikeLiked by 4 people

I guess from a cynics perspective when it was devised by the nats even the title GERS was likely to be considered a stroke of genius to attract the attention of those intrepid supporters of a certain Glasgow football team. But that aside you really have to admire the lengths the scottish media will go to now. STV are learning fast from their more obvious BBC reporting Scotland chums in undermining the SNP even when there is no ready made SNP bad meal to get their teeth into. In a rather innocuous item on todays news about helping more women to succeed in business we hear a young women saying that helping to reduce business bankruptcies by 50% would go some way in reducing Scotland’s fiscal deficit. If it wasn’t so pathetic you really have to chuckle at their futile almost daily attemps to keep us shackled to Westminster..

P.S. Don’t worry Prof will donate soon to your crowdfund once the pension arrives.

Robbo

LikeLiked by 2 people

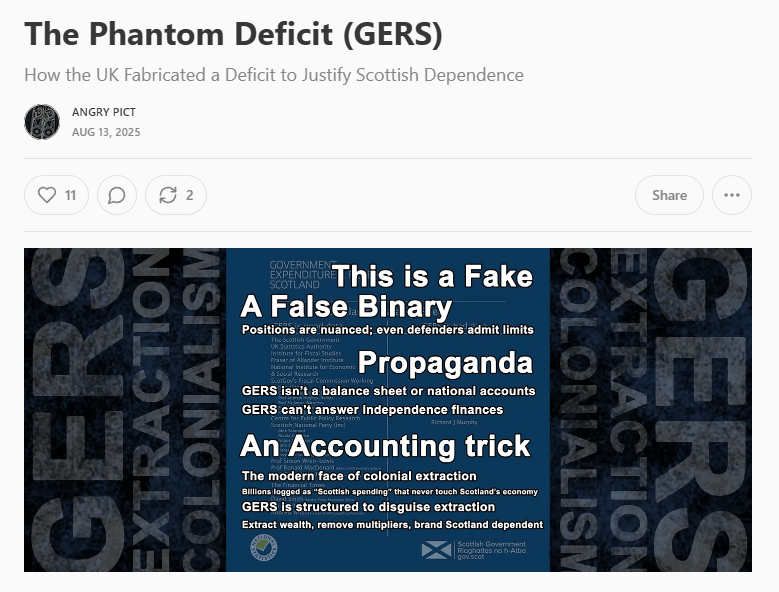

Robbo wrote that GERS was “devised by the nats”. It wasn’t: it was invented in 1992 by Ian Lang, the then Secretary of State for Scotland in the Tory Government of John Major. Its aim was to undermine growing support for devolution/independence in Scotland, which it did by employing single entry book-keeping – i.e. no Balance Sheet – and therefore capable of manipulation without detection.

Back in 2019 I analysed the sources of all the data from an audit perception in that year’s GERS publication by tracing all “costs” and “income” back to their source documents. Over 90% of the data was from UK-wide statistics from which Scotand’s share was estimated, often on a per capita basis. In other words less than 5% of the data was frpm Scotland-only data and therefore probably factual.

Another factor that is often overlooked is that these unreliable data represent a grossly unreliable picture of Scotland’s finances in the UK as it stands and can never be claimed to represent those of an independent or devolved Scotland. I other words they’re truly not worth the paper they’re printed on. If anyone wants an in-depth analysis of what’s wrong with GERS, Richard Murphy’s blogsite taxresearch.or.uk has been tearing it to bits for years.

As for the football analogy, given that the creators of GERS were right-wing pro-Union Tories there’s every chance that its name was meant as a p*ss-taking in-joke.

Coinneach

LikeLike

Just look at the accounts. Scotland raises pro rata more. Scotland has to pay interest on debt not borrowed or spent in Scotland. Scotland pays too much for the military. For less back. 180,000 military personnel. 10,000 based in Scotland. Scotland has to pay £1Billion for Westminster. Scotland in surplus in fuel and energy pay more. No parity. Nearer the source. Scotland lost £Billions to Brexit. Scotland did not vote for Brexit.

Devolution has improved Scottish economy. Independence would be even better.

LikeLike

Any Unionist GUESSTIMATE about Scots economic situation is just FICTION

LikeLike

Any Unionist GUESSTIMATTE anout Scotlands economic performance is FICTION. Sent from my iPhone

LikeLike